What Does Original Medicare Cover for Long Term Care?

What Does Original Medicare Cover for Long Term Care?

Long term care is almost a given for people at some point in their lives, especially as we get older. The older we get, the more likely we are to need help with daily tasks. The risk of a heart attack, stroke, or injury goes up as we age. In order to recover, most patients will need skilled nursing care, too.

According to the U.S. Department of Health and Human Services: Someone turning 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years

The bad news is that original Medicare does not cover long term care if what you need is primarily custodial care. This means help with bathing, eating, and dressing, along with other daily tasks.

Medicare Part A may cover skilled nursing care if it’s ordered by your doctor for rehabilitation. However, you have to meet several criteria.

You have to be admitted to the skilled nursing facility within 30 days of a qualifying hospital stay and for the same diagnosis.

Qualifying Hospital Stays Have Requirements with Medicare

What is a qualifying hospital stay? You have to be admitted to the hospital as a patient for three consecutive days, not simply for observation. As far as you’re concerned, there’s no difference between being under observation and being an inpatient. However, Medicare will treat them differently in terms of covering skilled nursing care. Therefore, be sure to tell your loved ones about this rule so that they can advocate for you with your doctors if you are not able to.

If you have a qualifying hospital stay and go to a skilled nursing facility, Medicare will pay 100% of the costs for the first 20 days. From day 21 to day 100, Medicare will continue to pay costs after your daily copay, which will be in the neighborhood of $170. After day 100, Medicare will not pay at all, and you will be responsible for all costs.

Now, keep in mind that all these rules do not apply for daily care at a nursing home if you are not able to care for yourself and you don’t have anyone else to help you. Medicare does not pay for nursing home care if it’s needed only for custodial care and not for rehabilitation.

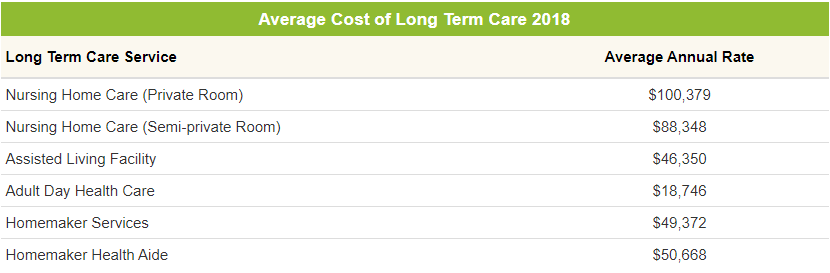

Here is a breakdown of each type of service and the Average Cost of Long Term Care:

It is certainly expensive and can quickly eat away at retirement dollars. AARP reports, “The number of people 70 and older in 2047 is projected to be twice as large as today potentially doubling the financial burden of care.”

Consequently, with costs and demand projected to increase sharply, the need to close the gap is vital.

Know Your Medicare Long Term Care Options

Medicare Supplement insurance plans, also known as Medigap, will pay for some care that original Medicare does not. This includes some copays, coinsurance and deductibles, and care you might receive while traveling internationally. However, Medigap plans do not pay for long-term care, prescription drugs, dental, vision, or hearing care.

Fortunately, there are programs that will bridge that gap. Medicare Advantage, also called Medicare Part C, is one good choice to get long-term care covered. Some plans also bundle in Medicare Part D for prescription drugs.

Knowing that you have the right coverage gives peace of mind. Avoid unexpected medical bill costs or finding out that you do not have coverage for a service you thought you did.

0 Comments