What is Medicare Part G?

What is Medicare Part G?

Now, before we dig through what Medicare Plan G covers, let’s take a quick stop at Medicare Part A and Part B. Medicare Parts A and B are also known as Original Medicare.

Original Medicare and the Gaps

Basically, they cover the big stuff like hospital visits (after your deductible is met) and medical insurance (you still pay 20% coinsurance). Medicare beneficiaries often find themselves with additional mounting out-of-pocket expenses. Handling those unplanned for expenses on a fixed budget creates a hardship.

Enter Medigap plans, also referred to as Medicare Supplements. These plans are distributed through individual carriers. Their purpose is to fill in the “gap” of what Original Medicare does not cover.

The ABCs of Medicare Supplements

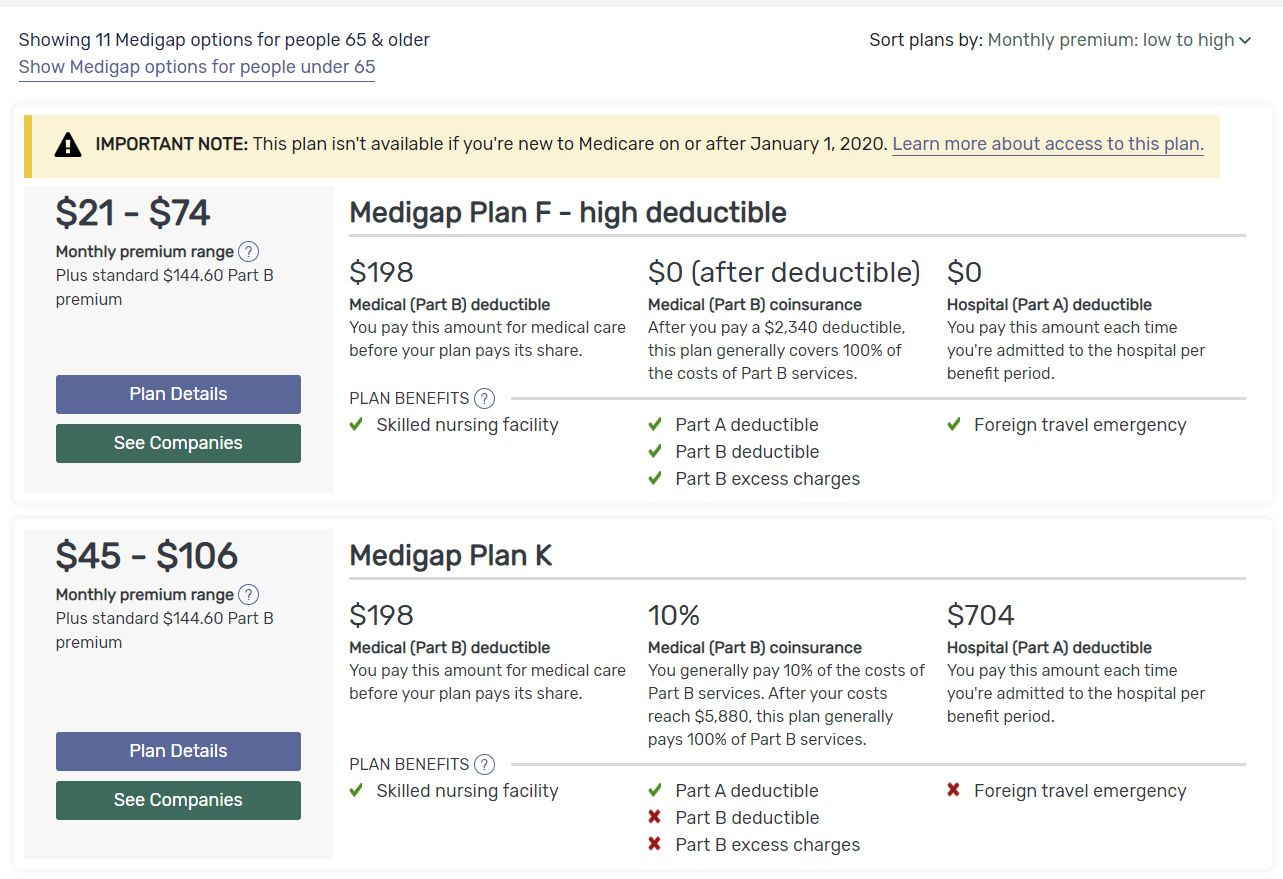

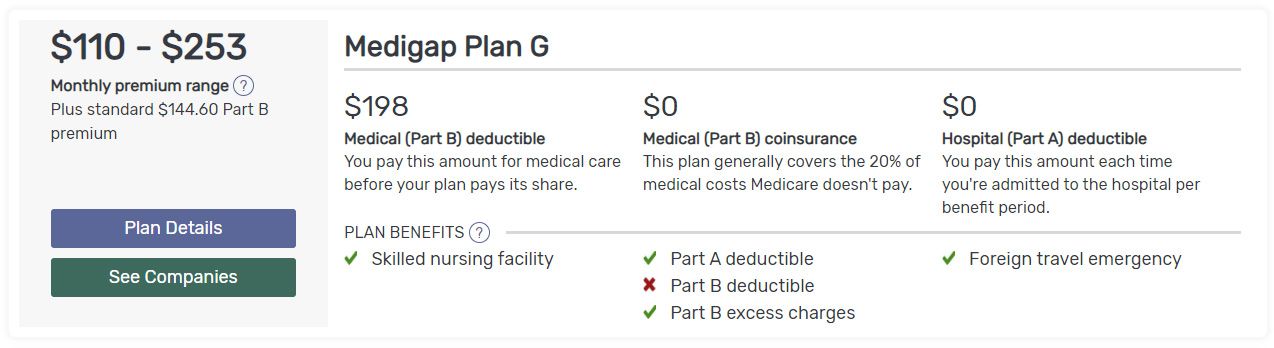

Each plan is named with a letter and provides a unique set of benefits to the Medicare beneficiary. Medicare.gov outlines how many plans are available by location and what each Medigap Plan covers:

Undoubtedly, reading all the plan options available can be overwhelming. However, Independent brokers and agents can help you navigate the benefits of each plan, weigh costs versus benefits, and find a plan that works best for your budget and needs at no cost.

One popular among Medicare beneficiaries is Medicare Plan G.

What Does Medicare Plan G Cover?

Medicare Plan G covers the out-of-pocket expenses left by Original Medicare (Part A and Part B), except for the Medicare Part B deductible.

The monthly premium range is $110 – $253 and will vary by location.

This means the Part B 20% coinsurance and copays, out-of-pocket expenses if you only had Original Medicare, would be picked up by your Medicare Part G Supplement.

In addition, The Part A deductible covering hospital stays is also paid out by Medigap Plan G. That cost is $1,408 in 2020 and increases slightly each year.

Another perk Medicare Plan G provides is a $50,000 lifetime limit in foreign travel emergency coverage.

What Medicare Plan G Supplements Do Not Cover:

Part B Deductible. The Part B deductible would still be an out-of-pocket expense. This is $198 in 2020 and increases slightly each year.

Prescription Drug Coverage. These are no longer covered under Medicare Supplements. Instead, there are standalone Prescription Drug Plans, such as Medicare Part D.

Is Medicare Plan G Better than Plan F?

If comparing straight benefits, the answer is ‘Yes’. Plan F includes everything Plan G does, plus it covers the $198 Part B deductible that Part G does not. However, the cost to cover that extra $198 varies by location. Thus, it is important to compare the cost of Plan F and Plan G. If the variance for Plan F is greater than the Part B deductible ($198 for 2020), then Plan G makes more sense.

Consult with an Independent Broker Specializing in Medicare Benefits

Navigating Medicare benefits and costs can be complicated. Often, Medicare beneficiaries begin with one plan and never change even though the plan benefits or costs have changed. Sometimes the beneficiary’s needs or budget have changed. We can match you with a licensed independent broker in your area that specialized in Medicare.

0 Comments